- The New Money

- Posts

- Lockheed's New Scandium Supplier, Mike Alfred Takes Opendoor Stake, And Tether Goes For Gold

Lockheed's New Scandium Supplier, Mike Alfred Takes Opendoor Stake, And Tether Goes For Gold

The markets and trends that matter, made simple. Discover what’s next.

Lockheed Martin And Sunrise Energy Metals Strike Scandium Supply Deal

Lockheed Martin (NYSE: LMT) entered into a new deal with Sunrise Energy Metals (OTC: SREMF) to purchase up to 15 tonnes of scandium oxide supply annually. Sunrise Energy Metals is co-founded by legendary mining entrepreneur Robert Friedland and owns the Syerston Scandium Project in Australia which is one of the world’s single largest scandium deposits. Scandium is a rare element that is a highly important material for aluminium alloys that are used in military aircraft and combat systems.

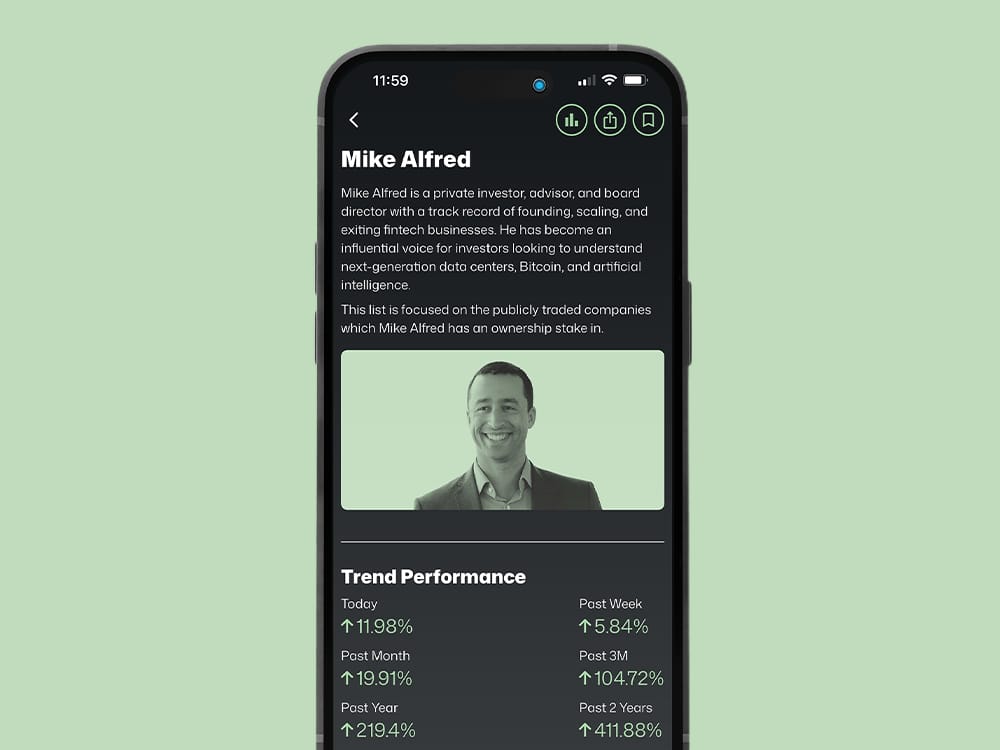

Mike Alfred Believes In The Future Of Opendoor

Entrepreneur and investor Mike Alfred publicly stated he has purchased a new equity stake in Opendoor Technologies (NASDAQ: OPEN). Opendoor has been experiencing a massive boom in retail investor attention lately, which has largely been fuelled by fund manager Eric Jackson and investor Anthony Pompliano taking positions in the company.

Tether Buys Stake In Gold Royalty Corp

Tether purchased 13.8 million shares of Gold Royalty Corp (NYSE: GROY) in the open market, acquiring an 8.1% ownership stake in the company. Gold Royalty Corp owns more than 250 royalties and streams globally, including interests in historic mining projects such as the Canadian Malartic and Goldstrike.

The New Money App has officially launched. Discover the world’s most exciting stocks, easier than ever before.

The Sprint

The National Hockey League formed a new multi year licensing agreement with American prediction market companies Kalshi and Polymarket.

Canadian brokerage company Wealthsimple launched a new feature to allow users to buy physical gold directly through their trading platform.

Autonomous vehicle and delivery company Avride landed up to $375 million of funding from Uber (NYSE: UBER) and Nebius Group (NASDAQ: NBIS).

The International Finance Corporation and Appian Capital Advisory are forming a new $1 billion fund to invest into copper projects globally.

WeRide (NASDAQ: WRD) and Uber (NYSE: UBER) teamed up to launch Saudi Arabia’s first robotaxis.

BitMine Immersion Technologies (NYSE: BMNR) publicly stated they have surpassed more than $13 billion in total assets.

ONE Nuclear Energy entered into a business combination agreement with Hennessy Capital Investment Corp VII (NASDAQ: HVII) to become a publicly traded company.

The Markets This Week

+91.1% | DataVault AI

+46.7% | BioAge Labs

+41.0% | Clover Health

+36.1% | Sonnet BioTherapeutics

+36.1% | Quantum eMotion Corp.

+31.9% | Asset Entities

+25.5% | Better Home & Finance

+24.1% | Syntec Optics

+24.0% | iRobot Corp.

+22.5% | Intuitive Surgical

Top Trends This Week

+9.3% | Hyperliquid Holders

+7.6% | Chamath Palihapitiya

+6.3% | Weight Loss Drugs

+5.8% | Mike Alfred

+5.2% | Stanley Druckenmiller

Trending Now

Looking to connect? Reach out and get in touch.

New here? Join our community of 100,000+ individuals interested in uncovering the world’s most exciting early stage companies.

Disclaimer: The New Money provides background information on early stage companies from publicly available sources. The New Money provides no advice on dealing in securities, is not a financial adviser and does not pretend to be so. This message is meant for information and educational purposes only. The information contained in this email is not to be considered factual or complete. Anybody interested in obtaining financial and other information on companies mentioned is advised to get it direct from the companies, or from their own investment adviser. The New Money does not intend for this information to be used to inform an investment decision. The New Money has been compensated by some of the companies mentioned in this email for awareness campaigns, which affects our ability to be unbiased. The Principals of The New Money may buy or sell shares of the mentioned companies without further notice. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. The New Money and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. Always do your own research and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy or Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.