- The New Money

- Posts

- Litecoin Comes To The Nasdaq, A Battery Breakthrough For Robotics, And MP Cashes Up For Rare Earth Expansion

Litecoin Comes To The Nasdaq, A Battery Breakthrough For Robotics, And MP Cashes Up For Rare Earth Expansion

The markets and trends that matter, made simple. Discover what’s next.

The Founder of Litecoin Is Backing A New Company On The Nasdaq

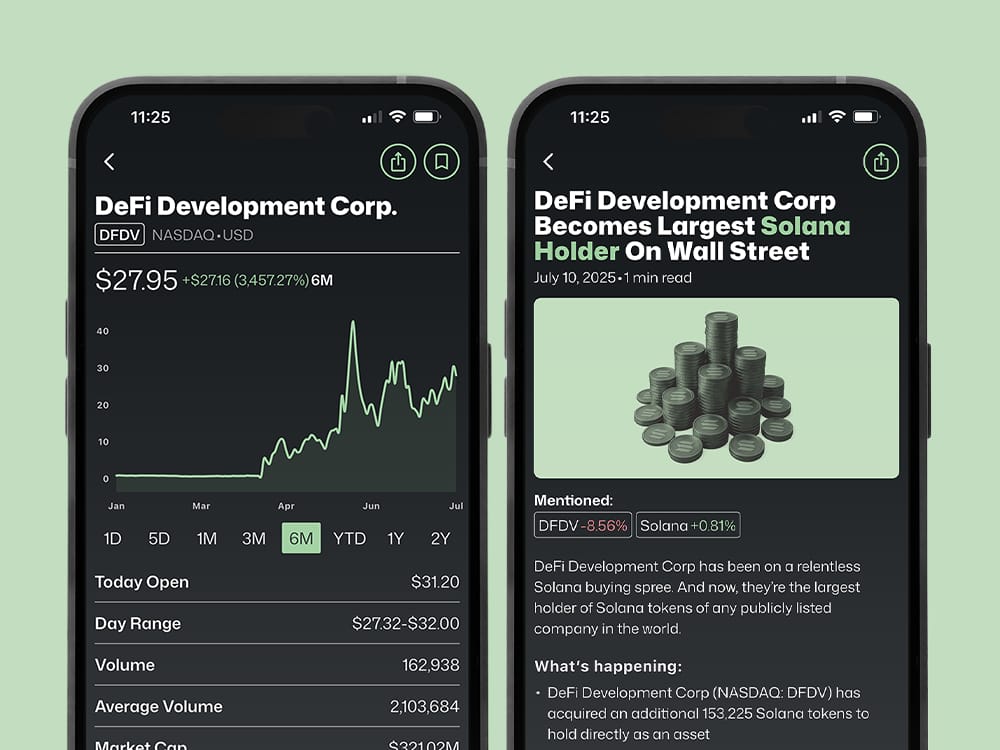

MEI Pharma (NASDAQ: MEIP) announced a $100 million equity financing round for the sole purpose of purchasing Litecoin, becoming the first publicly listed company on a major stock exchange in the United States to adopt Litecoin as a reserve asset. Litecoin’s founder Charlie Lee is a lead investor in the new funding round and will also join the board of directors of MEI Pharma.

Figure Unveils New Breakthrough Battery For Humanoid Robots

Figure officially unveiled their next generation F.03 battery, capable of powering their humanoid robotics for up to five consecutive hours, which is a 50% increase from what was previously possible. Figure recently announced plans to build a new facility located in California that can produce 12,000 new humanoid robots annually.

MP Materials Cashes Up For Rare Earth Expansion

MP Materials (NYSE: MP) raised $650 million in a new equity financing round led by Goldman Sachs and Morgan Stanley. The company recently made major waves when they cut a new $500 million deal with Apple (NASDAQ: AAPL) in which MP Materials will supply Apple with rare earth magnets for the manufacturing of new iPhones and Mac products.

The New Money App has officially launched. Discover the world’s most exciting stocks, easier than ever before.

The Sprint

Talen Energy (NASDAQ: TLN) is acquiring two large scale natural gas plants located in Ohio and Pennsylvania in a new deal worth $3.5 billion.

NexMetals Mining (NASDAQ: NEXM), owners of one of the largest copper, nickel and cobalt projects in all of Botswana, officially began trading on the Nasdaq.

President Donald Trump officially signed the GENIUS Act in to law to federally regulate stablecoins in the United States of America.

Cantor Equity Partners I (NASDAQ: CEPO) entered into a business combination agreement with Bitcoin Standard Treasury Company.

Uber (NYSE: UBER) made a $300 million strategic investment into electric vehicle company Lucid Motors (NASDAQ: LCID) and formed a new partnership focused on deploying thousands of Lucid vehicles as robotaxis globally.

The Novo Nordisk Foundation and the Export and Investment Fund of Denmark are jointly investing €80 million to start a new quantum computing company known as QuNorth in Denmark.

Defense manufacturing company Hadrian has raised $260 million in a new Series C financing round led by Peter Thiel’s Founders Fund and Lux Capital.

The Markets This Week

+189.5% | Opendoor Technologies

+120.8% | MEI Pharma

+96.6% | Telomir Pharmaceuticals

+62.9% | Argo Blockchain

+58.7% | QuantumScape Corp.

+51.6% | Solid Power Inc.

+49.2% | Critical Metals Corp.

+47.6% | Joby Aviation

+45.3% | Thumzup Media

Top Trends This Week

+27.5% | Chamath Palihapitiya

+23.4% | Rare Earth Elements

+20.4% | Electric Air Taxis

+18.4% | Nuclear Stocks

+17.7% | Battery Stocks

Trending Now

Looking to connect? Reach out and get in touch.

New here? Join our community of 40,000+ individuals interested in uncovering the world’s most exciting early stage companies.

Disclaimer: The New Money provides background information on early stage companies from publicly available sources. The New Money provides no advice on dealing in securities, is not a financial adviser and does not pretend to be so. This message is meant for information and educational purposes only. The information contained in this email is not to be considered factual or complete. Anybody interested in obtaining financial and other information on companies mentioned is advised to get it direct from the companies, or from their own investment adviser. The New Money does not intend for this information to be used to inform an investment decision. The New Money has been compensated by some of the companies mentioned in this email for awareness campaigns, which affects our ability to be unbiased. The Principals of The New Money may buy or sell shares of the mentioned companies without further notice. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities. The New Money and its principals and agents are not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. Always do your own research and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy or Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.